Worthwhile

Effortless and speedy, accessible from any location. Only one document required

Effortless and speedy, accessible from any location. Only one document required

Count on us as your innovative direct lender. We guarantee data privacy and offer help when you need it most

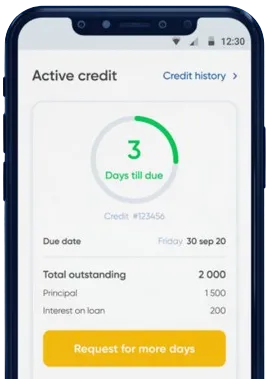

Straightforward solutions in just minutes from home. Money is transferred instantly; extend loans as needed

Fill out an application form directly in our app.

Wait briefly for our decision, typically 15 minutes.

Receive the transfer, usually completed within one minute.

In today's fast-paced world, unexpected expenses can arise at any moment. Whether it's a medical emergency, car repair, or home renovation, having access to quick loans can provide much-needed financial relief. In South Africa, quick loans have become a popular solution for individuals looking to bridge the gap between paydays or cover unforeseen expenses.

Speed: Quick loans are designed to provide fast access to funds, often within 24 hours of approval. This can be crucial when facing urgent financial needs.

Convenience: With online applications and minimal paperwork requirements, applying for a quick loan in South Africa is easy and convenient.

Flexibility: Quick loans can be used for a variety of purposes, from covering medical bills to consolidating debt or funding a special occasion.

Accessibility: Quick loans are available to a wide range of individuals, including those with a less-than-perfect credit history. This makes them a viable option for many South Africans.

Cost-Effective: Compared to other forms of credit, quick loans often have lower interest rates and fees, making them a cost-effective borrowing option.

Emergency Expenses: Quick loans can help cover unexpected costs, such as medical emergencies or home repairs, ensuring that you can address the issue without delay.

Debt Consolidation: If you have multiple debts with high-interest rates, a quick loan can be used to consolidate your debt into a single, more manageable payment.

Cash Flow Shortfalls: If you find yourself facing a cash flow shortfall before your next payday, a quick loan can provide the funds needed to bridge the gap.

When considering a quick loan in South Africa, it's important to compare options from different lenders to find the best terms and rates. Look for reputable lenders with transparent terms and conditions, and ensure that you understand all fees and charges associated with the loan.

Quick loans in South Africa can be a valuable financial tool for individuals facing unexpected expenses or cash flow shortfalls. With their speed, convenience, and flexibility, quick loans offer a practical solution for those in need of fast access to funds. By understanding the benefits and usefulness of quick loans, you can make an informed decision when seeking financial assistance.

A quick loan is a type of short-term loan that is typically approved and disbursed within a short period of time, often within 24 hours. These loans are designed to provide borrowers with instant access to funds to cover urgent financial needs.

Most lenders in South Africa offer online application processes for quick loans. You can simply visit the lender's website, fill out the application form, submit the required documents, and wait for approval.

The eligibility criteria for quick loans may vary depending on the lender, but generally, you need to be a South African citizen or permanent resident, be of legal age (18 years and above), have a regular source of income, and have a good credit history.

Quick loans in South Africa usually have short repayment terms, ranging from a few weeks to a few months. The repayment terms will be specified in the loan agreement provided by the lender.

Quick loans from reputable lenders in South Africa are generally safe to use. It is important to research the lender and read reviews from other borrowers to ensure that they are legitimate and trustworthy.

If you are unable to repay your quick loan on time, you may incur additional fees and interest charges. It is important to communicate with your lender and discuss alternative repayment options to avoid defaulting on the loan.